Life Insurance in and around Stratford

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

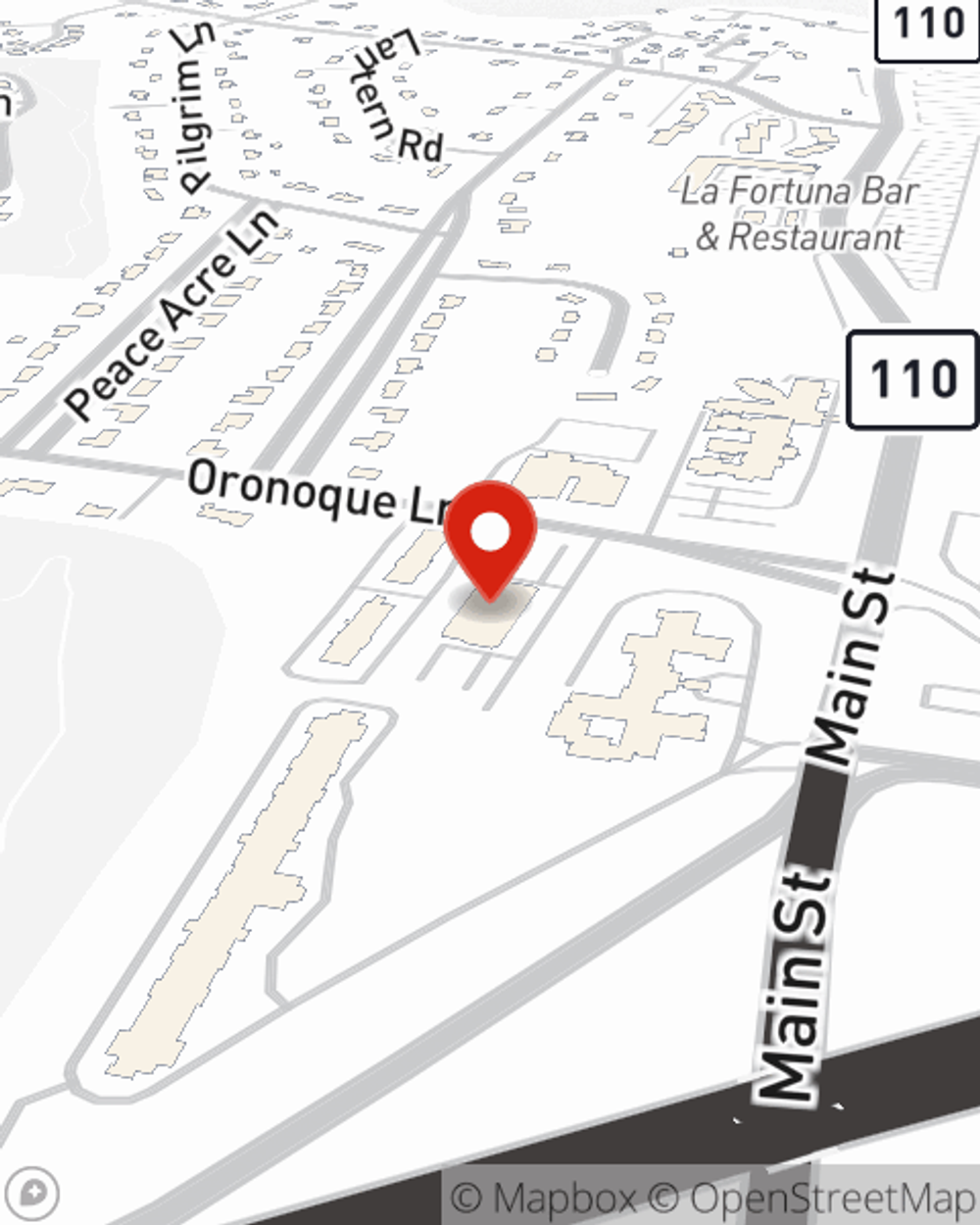

- Stratford Ct

It's Time To Think Life Insurance

When facing the loss of a family member or your partner, grief can be overwhelming. Regular day-to-day life halts as you prepare for arrange for burial funeral services, and come to grips with a new normal devoid of the one who has died.

Life goes on. State Farm can help cover it

What are you waiting for?

Put Those Worries To Rest

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Rocco Casinelli. Rocco Casinelli is the caring person you need to consider all your life insurance needs. So if you pass away, the beneficiary you designate in your policy will help the people you're closest to or your loved ones with certain expenses such as ongoing expenses, childcare costs and your funeral costs. And you can rest easy knowing that Rocco Casinelli can help you submit your claim so the death benefit is distributed quickly and properly.

With dependable, compassionate service, State Farm agent Rocco Casinelli can help you make sure you and your loved ones have coverage if the unexpected happens. Call or email Rocco Casinelli's office today to find out the options that are right for you.

Have More Questions About Life Insurance?

Call Rocco at (203) 750-1700 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Rocco Casinelli

State Farm® Insurance AgentSimple Insights®

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.